Review of Maleic Anhydride Market in 2023

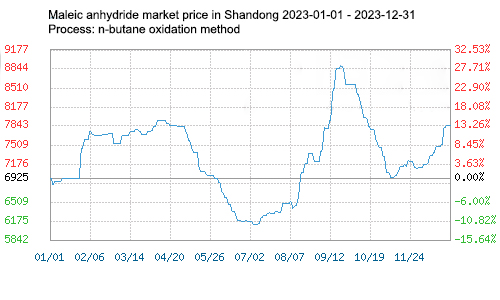

In 2023, the average market price of maleic anhydride in my country will increase by 13.50% from the beginning to the end of the year. The highest point during the year occurred on September 22, and the lowest point during the year occurred on July 5. The maximum amplitude during the year was 45.42%. In 2023, the domestic maleic anhydride market will fluctuate and rise.

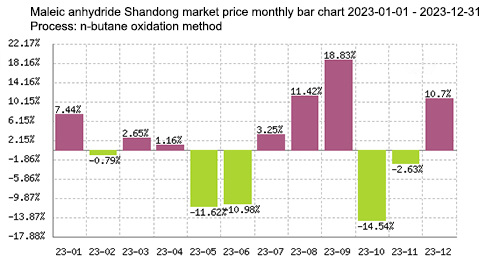

In 2023, the maleic anhydride market will rise more than fall, with 7 months of upward trends and 5 months of downward trends. The highest increase was in September, with an increase of 18.83%, and the highest decrease was in October, with a decrease of 14.54%.

Maleic anhydride prices continued to rise in the first quarter, with an increase of 11.77%. Due to the impact of logistics in early January, the circulating supply of maleic anhydride was limited, and downstream resins gradually entered a shutdown period. Procurement should be cautious and based on demand. After the holiday, the main factories pushed up prices actively, downstream demand returned to normal, and the willingness to enter the market was low. In February, the domestic maleic anhydride factory was shut down for maintenance, and there was less supply of goods circulating in the market. In addition, the upstream n-butane price of maleic anhydride continued to decline, and some downstream resins had a strong wait-and-see mood. They were cautious about pursuing higher prices and mainly purchased on demand. In the first ten days of March, the demand for downstream resins was stable. Some maleic anhydride manufacturers have stopped operations for maintenance. There is no pressure on the manufacturers to sell goods, and the price of maleic anhydride continues to rise. In late March, international crude oil fell sharply, upstream n-butane prices continued to decline, downstream resin costs and terminal performance were suppressed, and enthusiasm for maleic anhydride replenishment was limited, and the maleic anhydride market went down.

Maleic anhydride prices fell sharply in the second quarter, with a drop of 20.41%. The downstream resin market was weak in the second quarter. Resin manufacturers were not shipping smoothly, the market supply was sufficient, corporate inventories were high, and the ability to replenish maleic anhydride was limited. In addition, the price of raw material n-butane fluctuated downwards, and there was no obvious benefit to supply and demand. The market for maleic anhydride continued to decline. .

Maleic anhydride prices rose sharply in the third quarter, with an increase of 39.28%. In the third quarter, the market for maleic anhydride downstream resins increased, and the shipments of resin manufacturers improved. The downstream resins were in urgent need of replenishment, which supported the maleic anhydride market. The price of raw material n-butane fluctuated and rose, and the price of maleic anhydride continued to rise.

Maleic anhydride prices rose after falling in the fourth quarter, with an overall decline of 8.39%. In the fourth quarter, n-butane, the raw material for maleic anhydride, declined overall, and hydrogenated benzene declined overall. Maleic anhydride cost support is limited; the downstream unsaturated resin market is weak, and operations are cautious. The fundamentals are weak, the ex-factory price of maleic anhydride continues to decline, and the downstream wait-and-see sentiment is strong. In December, the market for hydrogenated benzene in the upstream of maleic anhydride increased, supported by the cost of maleic anhydride; the downstream unsaturated resin transactions were limited, and the market was mostly following suit; the price of the main maleic anhydride factory remained stable, and early orders were mainly executed.

Maleic anhydride market forecast in 2024

Cost side:

Raw material n-butane: In 2023, the n-butane market will mainly fluctuate and consolidate. The n-butane market is mainly affected by the large changes in the international crude oil market, coupled with the volatile and rising domestic naphtha market, which provides cost support for the n-butane market.

Raw material hydrogenated benzene: The average domestic market price of hydrogenated benzene will increase by 9.39% annually in 2023. Among them, the highest point during the year appeared on September 15, the lowest point during the year appeared on July 1, and the maximum amplitude during the year was 45.63%. In 2024, my country’s pure benzene capacity will continue to expand. In 2024, my country’s pure benzene plans to add approximately 2 million tons of new installations. Among them, the Shandong Yulong Petrochemical Refining and Chemical Integration Project will be the main new addition of pure benzene. my country’s pure benzene production will continue to expand. At the same time, the supply gap of pure benzene still exists, and imported supplies are being supplemented. Positive expectations for the hydrogenated benzene market in 2024 still exist. The overall market is expected to be stable and rise. Affected by crude oil fluctuations, there will be periodic fluctuations. In the future, we still need to focus on the market trends of crude oil, pure benzene, styrene, etc.

Supply side: In 2023, maleic anhydride production capacity will be 1.815 million tons, of which benzene production capacity is less than 30% and is basically at a standstill. The production capacity of the butane method is about 70%. Due to environmental protection, the price of hydrogenated benzene has risen sharply. The n-butane oxidation method has gradually replaced the benzene oxidation method as the main development trend. Domestic maleic anhydride production capacity is expected to increase by more than 600,000 tons in 2024, mainly concentrated in East China.

Demand side:

The unsaturated resin industry is still one of the largest demand areas for maleic anhydride, accounting for about 70%. In 2024, the future expansion rate of the UPR industry, the main downstream industry, will also slow down, and the oversupply situation of UPR itself will continue. Most manufacturing companies may continue to maintain low operating conditions, and 2024 will still be a year of significant capacity expansion. It is expected that new production capacity will be 800,000 tons, and the oversupply situation will continue. At the same time, some old devices with single products and backward processes will continue to be cleared.

In 2023, there will be adjustments in the main consumer fields of domestic UPR. The first place is fiberglass composite materials, accounting for 52%, the second place is artificial stone, accounting for 30%, and the third place is coatings, accounting for 12%. Finally, handicrafts account for 4%, and others (buttons, coatings, etc.) account for 2%. With the expansion of UPR application fields, the proportion of fiberglass reinforced products is declining, while the output of specialized and special products is increasing.

Forecast of the future market: At present, my country’s real estate industry has begun to transition to existing housing. The demand from traditional terminal industries has limited growth in the unsaturated resin industry, but the demand for unsaturated resins in the new energy and automotive fields has increased; maleic anhydride may have an important role in BDO and other industrial chains. breakthrough; but the current downstream demand has slowed down, the market is currently in a state of oversupply, competition among maleic anhydride manufacturers is fierce, and there are many uncertainties in the new maleic anhydride production capacity. The domestic maleic anhydride market may remain unchanged in 2024. Wide swing trend.

Post time: Feb-19-2024